Francisco Ceballos is a Research Fellow at the International Food Policy Research Institute (IFPRI), based in Washington, D.C. The IFPRI provides research-based policy solutions to sustainably reduce poverty and end hunger and malnutrition.

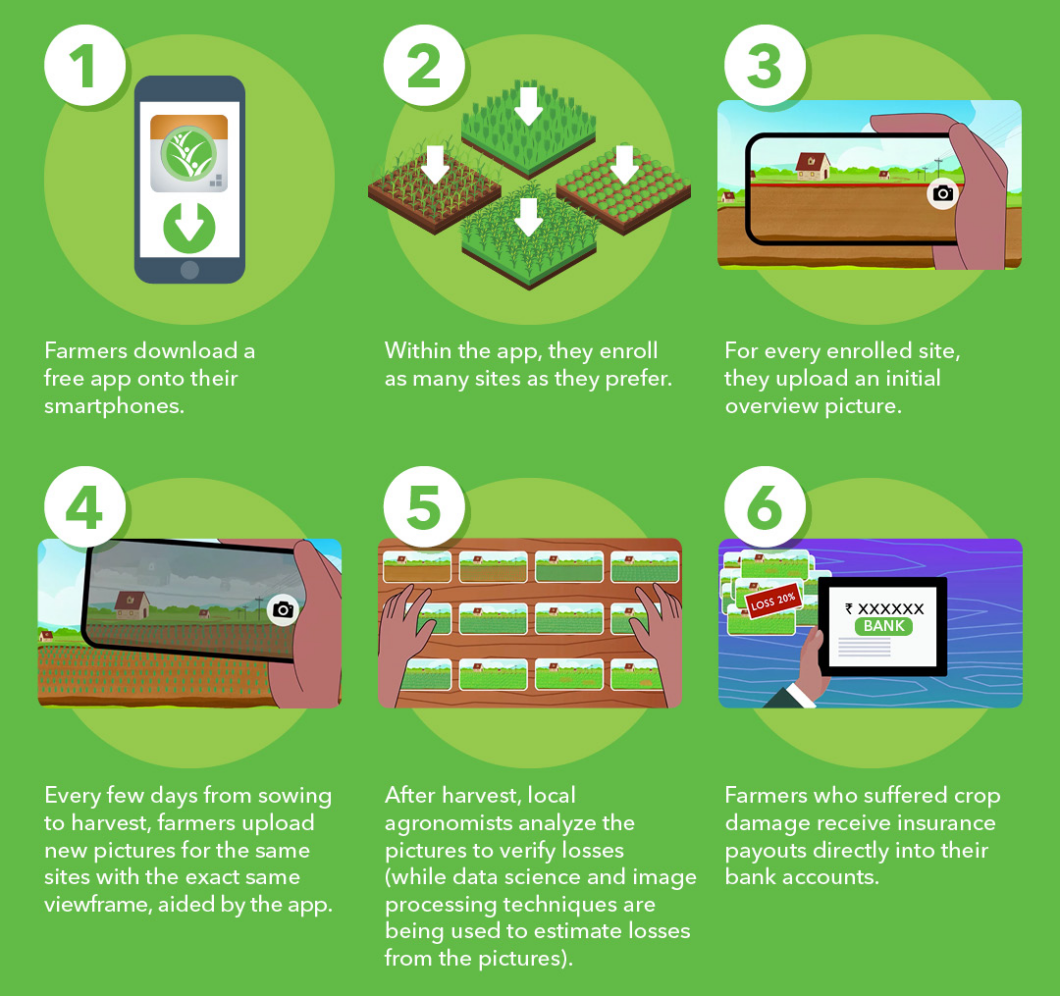

In this interview we learn more about Francisco and his work on agricultural Picture-Based Insurance (PBI) – a new and innovative way of delivering crop insurance using smartphone technology. Through an app, farmers submit geotagged, time-stamped pictures of insured sites from sowing to harvest. In response, they receive timely and relevant agriculture advisories and accurate field-level insurance coverage.

Francisco and his team have created a PBI Playbook, featured on the Digital Impact Exchange, to help others incorporate PBI into their work.

How did you find your way to the work you are currently doing? What is your background?

I’m originally from Argentina, where I studied Economics and Finance. I came to D.C. in 2005, to work on macroeconomics and international finance at the World Bank. Many years later, I had the opportunity to join IFPRI to work on agricultural insurance, a topic which I had been following in my spare time.

Suddenly, I found myself enjoying development economics a lot, due to how much more grounded it felt compared to macro, and I eventually delved heads on into it by pursuing a PhD in Agricultural Economics at the Göttingen University, Germany.

What is the biggest challenge you face in your role or that your organization at-large faces as it pursues its mission?

Back in 2012, when I started working at IFPRI, index insurance was a promising idea to close the large gap in agricultural insurance coverage in the developing world.

Index insurance is a general class of insurance products that trigger a payout based on the value of an objective index (such as temperature or rainfall readings at a nearby weather station). In contrast to traditional indemnity insurance, where the insurance company must physically send an adjustor to each farmer’s field to assess losses, index insurance can be provided much more affordably, a key aspect to spur demand in low-income settings.

However, unlike indemnity insurance, index products suffer from what’s known as ‘basis risk’, the risk that an index does not accurately estimate losses at a given farmer’s field, which can result in farmers not getting the payouts they need during bad years (or, vice versa, getting payouts during good years).

In 2016, my colleagues Berber Kramer, Miguel Robles and I were thinking of ways around this conundrum in the agricultural insurance landscape. We wondered if we could take advantage of the ever-increasing availability of smartphones in rural areas, and simply use smartphone pictures to evaluate crop damage, combining the best of both indemnity and index insurance: affordable insurance for field-level losses.

We launched a pilot in India to test this idea, for which we developed an Android app, which could work offline to account for the lack of network availability in many of our study areas. We enrolled farmers and explained to them how to use the app, and they sent in pictures to document crop growth and damage throughout the agricultural season. We then got local experts to look at the stream of pictures from each farmer, determine crop damage, and issue insurance payouts.

The results were quite encouraging: farmers were willing and able to send in pictures, experts could identify severe damage from pictures, and farmers’ feedback was very positive; they genuinely seemed to like the idea. We thus realized we were onto something.

What other technology tools do you use in your work?

During the Picture-Based Insurance (PBI) pilot, we soon had hundreds of farmers sending pictures of their fields on a regular basis. At the same time, we were getting additional information through the app, such as when farmers planted their seeds, what varieties they used, and what types of shocks damaged their crops. With these ‘eyes on the ground’, we started thinking about ways to use this wealth of data and pictures to provide farmers with more valuable services.

The first step in this regard was around agricultural extension. Aside from assessing damage at the end of the season, local experts could assess the incoming images in real time, identify any visible issues, and send farmer-specific, tailored recommendations on how to cure or prevent them.

We called this Picture-Based Advisories (PBA), an idea on which we have continued working until today, and for which we are currently conducting an impact evaluation. Over the years, we have also bundled PBI with additional value-added services, such as agricultural credit or seeds of improved varieties.

What initially brought you to the Digital Impact Exchange?

The Digital Impact Exchange came to us! The CGIAR made a spotlight on our Seeing is Believing project, where we initially tested the personalized advisories idea, and Sarah Farooqi from DIAL contacted us to create a Playbook.

How do you hope the Exchange will help you in your work?

We get a lot of requests on how to design a PBI product. We hope that using this playbook, more people can at least get a sense of the basics, so that they can start incorporating the PBI approach into their insurance products. We also are aiming to make the smartphone application available through the Exchange, so that it is easier for other organizations to start testing PBI within their insurance operations.

What is the best book you’ve read recently?

“Gödel, Escher, Bach: An Eternal Golden Braid,” by Douglas Hofstadter. I’ve been wanting to read it for a while and I finally came around to it last year. It’s thick and dense at times, but it’s a fascinating read. I also recommend this recent article of his, which links the book to the recent AI buzz with ChatGPT and similar tools.